sales tax oklahoma tulsa ok

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The current total local sales tax rate in Tulsa OK is 8517.

Sales tax exemptions apply to Interstate 1-800 WATS and interstate private-line business telecommunication services and to cell phones sold to a vendor who transfers the equipment as part of an inducement to a consumer to contract for wireless telecommunications.

. Tulsa County 0367. Shawnee OK Sales Tax Rate. State of Oklahoma - 45.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Ponca City OK Sales Tax Rate.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The most populous zip code in Tulsa County Oklahoma is 74012. The City has five major tax categories and collectively they provide 52 of the projected revenue.

State of Oklahoma 45. Tulsa County - 0367. The December 2020 total local sales tax rate was also 8517.

Tulsa OK Sales Tax Rate. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Sales tax at 365 2 to general fund. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. The Tulsa Sales Tax is collected by the merchant on.

Sapulpa OK Sales Tax Rate. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 51. Owasso OK Sales Tax Rate.

There is no applicable special. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. What is the sales tax rate in Tulsa OK.

The Oklahoma sales tax rate is currently 45. Tulsa Sales Tax Rates for 2022. The average cumulative sales tax rate between all of them is 828.

How much is tax by the dollar in Tulsa Oklahoma. Automate sales tax compliance in the programs you use with Avalara AvaTax plugins. The Oklahoma sales tax rate is currently.

Sand Springs OK Sales Tax Rate. As far as other cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. 2871 S Gary Ave Tulsa OK 74114 699900 MLS 2223617 Beautiful Midtown home with your very own resort style backyard pool hot tub cozy fire pi.

4640 S Quaker Ave Tulsa OK 74105 319000 MLS 2218350 Gorgeous home near Brookside and the Gathering Place. Ad New State Sales Tax Registration. 3 beds 25 baths 2847 sq.

State of Oklahoma 45 Tulsa County 0367 City 365. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. 31 rows Norman OK Sales Tax Rate.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The Tulsa sales tax rate is. The minimum combined 2022 sales tax rate for Oklahoma City Oklahoma is 863.

Integrate Vertex seamlessly to the systems you already use. The County sales tax rate is. This is the total of state county and city sales tax rates.

Stillwater OK Sales Tax Rate. Ad Automate Standardize Taxability on Sales and Purchase Transactions. This is the total of state county and city sales tax rates.

Oklahoma Sales Tax Rates information registration support. We would like to show you a description here but the site wont allow us. The most populous location in Tulsa County Oklahoma is Tulsa.

A display for childrens clothes at Drysdales in. 5 beds 25 baths 1898 sq. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

Sales Tax in Tulsa. For more information contact the Oklahoma Tax Commission at 405521-3133. Five bedrooms with 3 baths and 2 li.

Oklahomas first sales-tax-free weekend brought shoppers from all over to Tulsa stores from Aug. Tulsa OK Sales Tax Rate. Oklahoma City OK Sales Tax Rate.

This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but an individual who owns a store. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

An example of an item that exempt from Oklahoma is prescription medication. City 365. How much is sales tax in Oklahoma City.

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law

How Oklahoma Taxes Compare Oklahoma Policy Institute

Taxes Broken Arrow Ok Economic Development

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Oklahoma Sales Tax Small Business Guide Truic

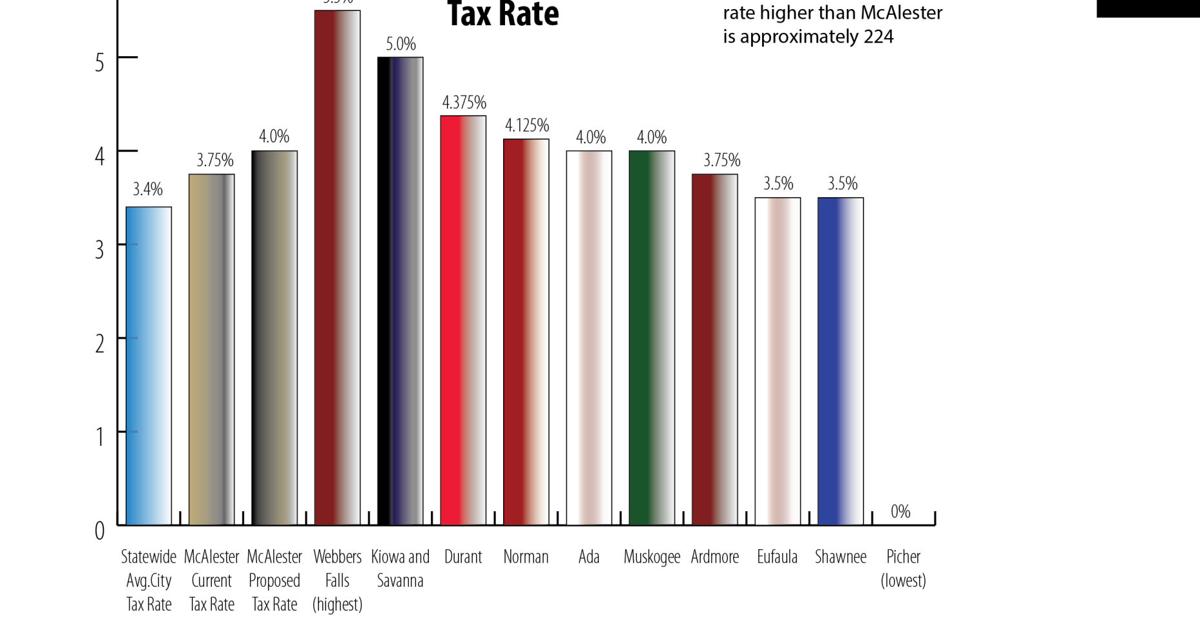

Many Sales Tax Rates Across Oklahoma Higher Than Mcalester S Local News Mcalesternews Com

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

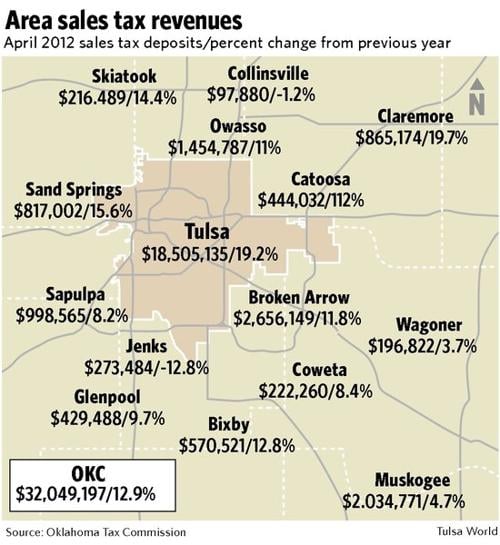

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Tax Commission Linkedin

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

State And Local Tax Distribution Oklahoma Policy Institute

Follow Oklahoma Tax Commission S Oktaxcommission Latest Tweets Twitter

Oklahoma S Tax Mix Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute